Last updated: Feb 2020

==

Looking for expert advice on EVs in India? Talk to EAI’s EVNext team for market & strategic inputs. Know more

Wish to know everything about India’s EV market from one place? Check out the India EV Expert Guide, a 900 page comprehensive guide to the Indian EV market. Know more

==

Introduction

The rise of electric vehicles (EVs) has caused upheaval in the lithium ion battery industry. Before Elon Musk announced Tesla’s intention to build the world’s biggest lithium ion battery plant, The Giga factory 1, lithium ion batteries were somewhat of a cottage industry geared to supplying a mobile consumer market for smartphones, laptops, and power-tools. As we firmly settle into the 21st Century, the lithium ion battery industry has become one of the most critical globally as its role in the energy storage revolution becomes more and more apparent. Lithium ion battery powered EVs are becoming larger in capacity and being built quicker than the majority expected. The energy storage (ESS) market – large battery packs that can store renewable, off-grid energy – is also growing at a much quicker rate, particularly for Peaker Plant replacements at times of high demand.

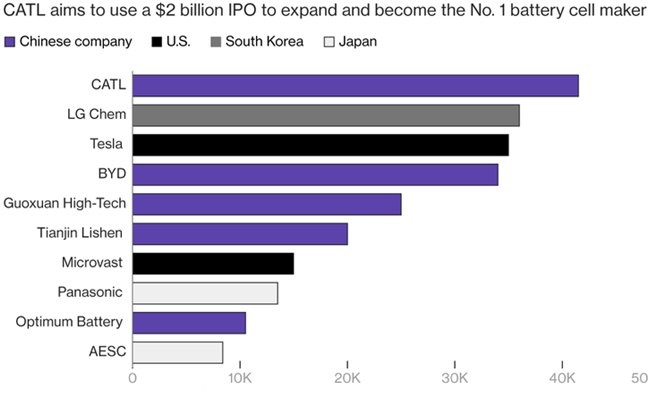

The graph shows the MWh of EV Li-ion batteries produced by top battery manufacturing companies.

One unmistakable trend from the above data is the exceptional growth of the battery market globally. Registering a massive 60% year-on-year growth in 2015, this march has continued into 2016 when once again based on extrapolation of data above, a 40-50% growth appears to have happened.

Another key trend from the data above is also how Chinese firms such as BYD, Wanxiang and BPP are fast gaining over companies such as LG Chem and Samsung. In fact, this trend of the Chinese battery firms accelerating their market domination increased even further in 2017.

CATL is a leading Chinese battery company. Founded in 2011 and headquartered in Ningde, Fujian province, CATL focuses on the production of lithium-ion batteries and the development of energy storage systems. With manufacturing bases in Qinghai, Jiangsu and Guangdong provinces, CATL has 7.7 GWh of battery capacity (as of Aug 2017) and plans to have a battery production capacity of 50 GWh by 2020. Like BYD, CATL is the type of company that the Chinese government wants to support and promote as a national champion.

Other companies in the battery manufacturing segment are Tianjin based Lishen Battery and Hangzhou’s Wanxiang Group.

Both new markets have become heavily lithium ion-dependent which has resulted in a lithium ion battery growth trajectory that vastly exceeds expectations of just a few years ago. Lithium ion battery demand has grown from a production base of 19 GWh in 2010 with a total installed capacity of 30 GWh, to a production of 160 GWh in 2019 with a total installed capacity of 285 GWh. In the next decade, the industry is heading into a multi-terawatt (TWh) world as major cell producers build a blueprint of battery mega factories across multiple continents. Benchmark Minerals’ Lithium ion Battery Mega factory Subscription now has 68 plants in the pipeline with a total capacity of 1.45 TWh by 2028, as of January 2019 assessment. It is to be noted that in Q1 2015, only three mega factories were planned.

Top 5 Lithium Ion Battery Producers by Capacity – Global

LG Chem: A Multi-Continent Assault

Cell capacity expansion at LG Chem saw the South Korean lithium ion battery producer rise to the number one spot with a capacity of 51 GWh in 2018, exclusive data from Benchmark Mineral Intelligence has shown.

LG Chem has been one of the most aggressive in expanding its lithium ion cell capacity in the last two years (2016-18) and has pushed ahead with a five mega factory approach on three continents.

The battery producer’s new flagship plant in Poland became one of the world’s largest in 2018, while it expanded its cell facility in Nanjing, China and committed to building a second facility adjacent to this plant by 2023.

In 2018, LG Chem’s lithium ion battery plant in Holland, Michigan, US implemented an expansion for its existing Chevrolet and Chrysler models in a bid to gain new business from the North American EV space.

The fifth battery mega factory in the LG Chem portfolio is its Ochang, Korea facility which is only expected to expand to meet existing customer demand from Japanese and Korean clients such as Nissan.

It is to be noted that the Chinese lithium ion battery companies, CATL, together with BYD, Panasonic or Tesla do not have the world’s biggest battery production base despite well publicized successes.

In fact, these four battery producers are in the second, third, fourth and fifth position, respectively, as they all build out new production bases for the global EV and energy storage demand surge.

CATL: Jiangsu Megafactory Leads Expansions

CATL, the lithium ion cell manufacturer and a leading firm for this mid-section of the supply chain, continued to increase its expansion plans for the future on the back of its IPO in June 2018. It announced two new lithium ion battery plants in Germany and Guangzhou while expanding its primary production base in Ningde. Meanwhile, its biggest expansion of 2018 was at its Jiangsu battery plant which tripled in size to supply China’s EV and energy storage markets. CATL’s total lithium ion battery capacity is under 40 GWh a year as of 2019. One of the major challenges for CATL is to produce the same quality as the battery industry’s tier one suppliers – Panasonic, Samsung SDI, and LG Chem. Quality has been one of the major concerns for western electric vehicle manufacturers that are seeking multi-gigawatt-hour supply of lithium ion battery cells on an annual basis. While CATL has been a part of these major supply chain discussions, the balance of power still continues to lie with its Korean and Japanese counterparts.

BYD: Qinghai Battery Plant Doubles Capacity

BYD, China’s premier EV producer which is vertically integrated to supply its own lithium ion battery needs, opened its newest battery mega factory in Qinghai in 2018 which essentially doubled the company’s EV lithium ion battery capacity. The battery mega factory doubled down on BYD’s commitment to supply chain integration as it pushes to build a huge lithium carbonate plant in the same region. BYD also announced two new plants in Shaanxi and Chongqing, which took its number of mega factories in the pipeline to five. The new plants are expected to come on stream in 2023 while the company has also expanded its existing cell facility in Shenzhen with new NCM and LFP lines. BYD’s fifth plant, for which there is presently no plans to expand, is based in Huizhou.

Panasonic – Tesla: Gigafactory 1

Panasonic and Tesla, in 2018, entered into an agreement to set up the first joint ventured lithium ion battery manufacturing unit in Gigawatt scale. The partners have plans to set up 3 Giga factories in the near future. The Tesla Giga factory 1, of which Panasonic is a shareholder, expanded its 2018 capacity to 22 GWh in 2018 while the company was operating at a utilization rate of 92%, the highest in the lithium ion battery industry. This has given Tesla the confidence to push ahead with the Giga factory 3 in China, plans for which have crystallized over the last six months (starting 2019). While the new fully integrated EV battery plant will not be producing cells any time soon, it has entered Benchmark Minerals’ Lithium ion Battery Mega factory Assessment in 2023 at a capacity of 15 GWh. In the next three years, Tesla is expected to rely on Chinese lithium ion battery producers or at least Chinese-based cell production to supply Model 3 and the newly planned, Model Y.

Outside of the Giga factory, Panasonic already operates four lithium ion battery plants in Japan and its new facility in Dalian is expected to be one of its largest facilities. In total, this has given Panasonic a capacity base of 20.5 GWh outside of the Giga factory. A large proportion of this is in the form of 18650 cells produced at Suminoe and consumed by Tesla in the Model S and Model X. Perhaps the most defining development for Panasonic was announced in late-January 2019. Toyota and Panasonic formed a joint-venture (51:49) company to develop and produce lithium ion, solid state and other next-generation battery technologies for the automotive industry. The synergies are clear for both players that have dragged their heels in the lithium ion powered EV race. For Toyota, the world’s second largest auto producer in 2018, it is a rapid route into the lithium ion powered EV space after spending so many years pushing for fuel cell technology. For Panasonic, it ties in a major auto producer that manufactures in the double-digit millions of units and reduces its reliance on Tesla. It is also the first major deal in a trend that is seeing the automotive sector and lithium ion battery space become increasingly integrated.

Upcoming Battery Manufacturing Facilities

| OEM | Country | Announcements |

| Panasonic | United States | 35 GWh/year factory by 2020. |

| China | 24 GWh/year and 18 GWh factories in 2020. | |

| CATL | European Union | 14 GWh/year factory in 2021. |

| 98 GWh/year factory (date to be determined) to be launched. | ||

| BYD | China | 24 GWh/year factory in 2019.20 GWh/year and 30 GWh factories in 2023. 10 GWh/year factory (date to be determined). |

| LG Chem | European Union | 15 GWh/year factory in 2022. |

| China | 32 GWh/year factory in 2023. | |

|

SK innovation |

China | 7.5 GWh/year factory in 2020. |

| European Union | 7.5 GWh/year factory in 2021. | |

| United States | 9.8 GWh/year factory in 2022. | |

| LIBCOIN/BHEL | India | 30 GWh/year factories, in 2025, 2026 and 2027. |

| Samsung SDI | European Union | 1.65 GWh/year factory in 2020. |

| Northvolt | European Union | 32 GWh/year factory in 2023. |

| Lithium Werks | China | 8 GWh/year factory in 2021. |

| Terra E | European Union | 4 GWh/year factory in 2020. |

==

Looking for expert advice on EVs in India? Talk to EAI’s EVNext team for market & strategic inputs. Know more

Wish to know everything about India’s EV market from one place? Check out the India EV Expert Guide, a 900 page comprehensive guide to the Indian EV market. Know more

==

See also the related blog posts

- Prices of Electric Cars – Global – Cost of Electric Cars, Electric Buses – Tesla, Nissan, Toyota, BMW, BYD, Volt, Bolt, Honda

- Cost of Li-ion Batteries – Cost Trends 2018-2030 – $/kWh with Break-Ups

Check out the following sections for comprehensive inputs on Indian EV ecosystem (click on each section for more details)