Strategic Insights Report: Agri Waste To Value

About Us

Energy Alternatives India (EAI)

India’s leading catalyst for climate tech since 2008.

▶ Domains: Renewable energy | Low-carbon mobility | Sustainable materials | Clean environment

▶ Services:

• Strategic & market intelligence

• Startup & innovation ecosystem support

• Geo-targeted decarbonization solutions

Net Zero by Narsi

Insights and interactions on climate action by Narasimhan Santhanam, Director - EAI

View full playlist▶ Track Record: Solar, biomass, decarbonization, biofuels, green chemicals and more.

→ Powering India’s sustainable growth & climate action

→ Assisted 100+ companies including JSW Energy, ExxonMobil, Vedanta, GE, GSW…

INTRODUCTION

India, one of the world’s largest agricultural economies, generates over 500 million tonnes of crop residue annually—a figure that continues to grow with rising food demand. Yet, a large portion of this biomass remains underutilized or burnt, leading to severe environmental pollution, lost economic opportunity, and inefficient resource use.

This presentation explores the transformative potential of the “Agri Waste to Value” sector—where agricultural residues are converted into high-value products such as biofuels, bioplastics, organic fertilizers, animal feed, biochar, and green chemicals. With rising concerns over climate change, energy security, and sustainable rural development, this sector offers not just an environmental imperative but also a profitable business opportunity.

From government incentives and emerging circular economy models, to technological innovations and investor interest, the time is ripe to harness agri waste as a strategic resource—fueling both green entrepreneurship and India’s net-zero aspirations

Market Size

India’s Agri-Waste Landscape

- Over 500–600 million tonnes/year of agri waste generated.

- ~65–70% remains underutilized or openly burnt.

- Huge untapped opportunity for value addition and circular economy models.

Current Market Size (2024 Estimates)

- Total sector size: $5–6 billion (₹42,000–50,000 crore)

Breakdown by key verticals:

| Segment | Market Size (2024) |

|---|---|

| Bio-CNG / Biogas | $1.5–2 billion |

| Biofuels (ethanol/biodiesel) | $2 billion |

| Bioplastics | $500 million |

| Biofertilizers / Compost | $800 million |

| Animal Feed | $300 million |

Growth Potential & Key Drivers

Future Growth Trajectory

- Expected to grow to $12–15 billion by 2030.

- CAGR across segments: 12–25%, depending on policy and tech adoption.

Growth Drivers

- Government Policy Support: SATAT, GOBARdhan, Waste to Wealth Mission, Ethanol Blending.

- Climate Imperatives: Net Zero by 2070; ESG-linked investments.

- Innovation & Technology: Enzyme-based composting, torrefaction, pyrolysis, AD tech.

- Rural Livelihood Boost: Decentralized waste collection and processing models.

- Industrial Demand: For biofuels, organic inputs, green packaging materials.

India is well-positioned to lead the global shift toward bio-based circular economies, leveraging agri-waste as a high-impact resource.

Competitive Landscape – Agri Waste Product Manufacturers in India

| Product Vertical | Key Players | Nature of Competition | Key Notes |

|---|---|---|---|

| Bio-CNG / Biogas | – GPS Renewables – EverEnviro – Think Gas – IndianOil (SATAT partnerships) |

Fragmented but rapidly scaling | Over 200+ plants under SATAT, high govt. support. |

| Biofuels (Ethanol, Biodiesel) | – Praj Industries – Godavari Biorefineries – IndianOil – HPCL Biofuels |

Semi-consolidated, large players dominate | Govt. OMCs key buyers; 20% ethanol blending target by 2025. |

| Bioplastics / Compostable Packaging | – EnviGreen – Earthware – TrueGreen – Biogreen |

Nascent, innovation-driven startups | High margins but expensive tech; growing exports. |

| Biofertilizers / Compost | – IPL Biologicals – Nova AgriTech – AgriLife – KMB Fertilizers |

Highly fragmented; regional dominance | Low entry barrier; often bundled with agri extension. |

| Animal Feed from Agri-Waste | – Godrej Agrovet – Amul (via fodder innovation) – Kemin – Local cooperatives |

Regionally clustered; integrated players | Cost-effective for dairy/poultry; logistics-sensitive. |

| Biochar / Torrefied Fuel | – CarbonCraft – Takachar – Husk Power – Agriya Biochar |

Emerging niche, tech-centric startups | Climate finance and carbon credit potential rising. |

Investment Requirements & Payback

| Sl No. | Agri‑waste Product & Reference Scale | Typical Green‑field CAPEX* (₹ crore) | Payback Period (yrs) | IRR (% p.a.) | ROI / ROR (% p.a.) | Key Notes |

|---|---|---|---|---|---|---|

| 1 | Bio‑CNG / CBG – 10 TPD (≈1 t CBG/day) | 10 – 12 | 3 – 4 | 18 – 22 | 18–22 | SATAT/GOBARdhan CFA up to ₹10 cr; machinery ≈75% of CAPEX |

| 2 | Ethanol (1G) – 100 KLPD grain/molasses distillery | 100 – 150 | 4 – 5 | 21 – 23 | 20–23 | DPR for 60–100 KLPD plants show IRR ≈ 23%, DSCR > 1.8 |

| 3 | Biodiesel – 30 TPD multi‑feed unit | 4 – 5 | 2 – 3 | 14 – 16 | 15–18 | Feedstock cost dominates OPEX (≈85%); CAPEX ≈ ₹1.5–2 lakh / t y capacity |

| 4 | Bioplastics (bags/films) – 2 t/day compostable bag line | 1 – 2 | 2 – 3 | 22 – 30 | 25–40 | Modular extrusion + bag‑making; margins rise with PLA/PBAT price premium |

| 5 | Bio‑fertiliser / PROM – 1 t/day blended unit | 1.0 – 1.5 | 2.5 – 3.5 | 22 – 28 | 25–36 | Low‑pressure equipment; subsidies under NPOF |

| 6 | Animal feed (bagasse/DDGS) – 100 TPD pelleting plant | 12 – 14 | 4 – 5 | 20 – 24 | 26–30 | Bagasse or DDGS; AHIDF offers 3% interest subvention |

| 7 | Biochar + Carbon credits – 100 TPD pyrolysis hub | 150 | 4 – 6 | 18 – 25† | 18–25† | Large hub model (BiocharIND) targets 25 kt CO₂e yr⁻¹ at €40–65 / t credit; CAPEX ₹1.5 bn |

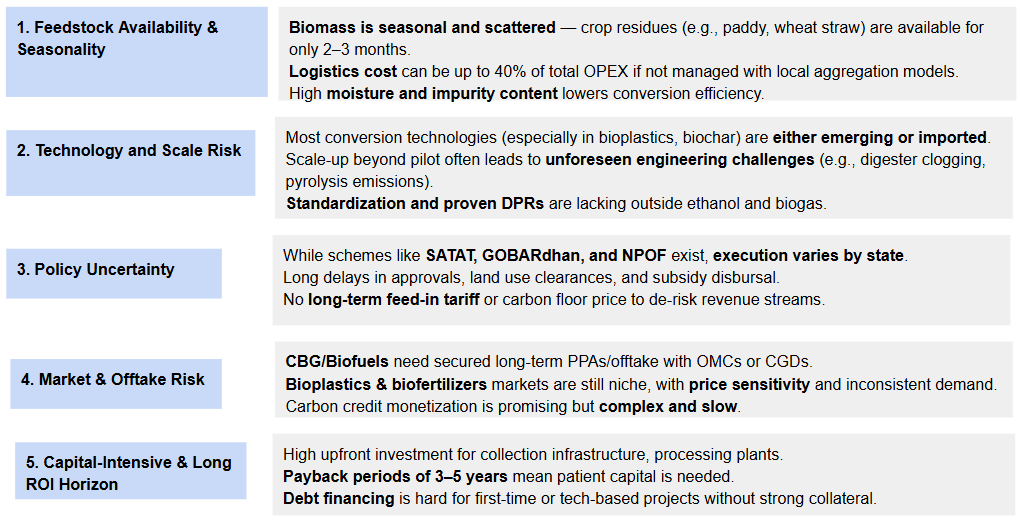

Challenges for Investors in Agri Waste to Value Sector

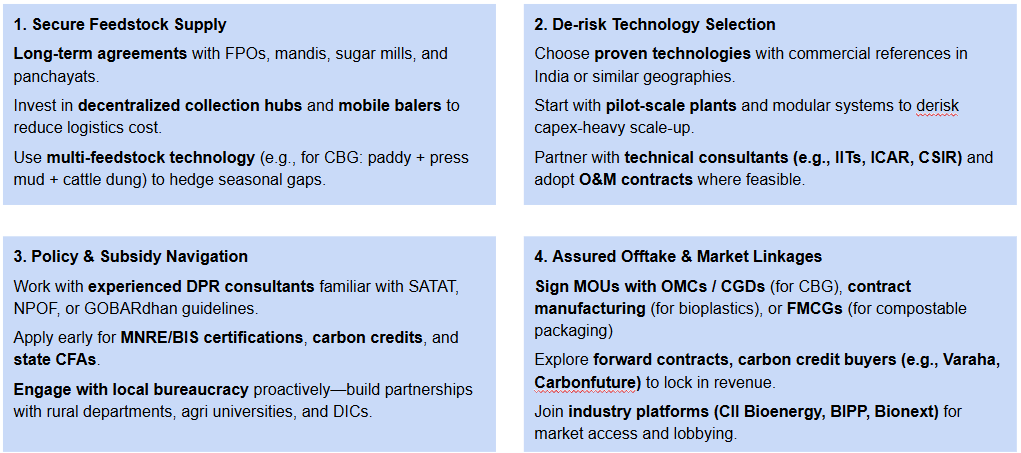

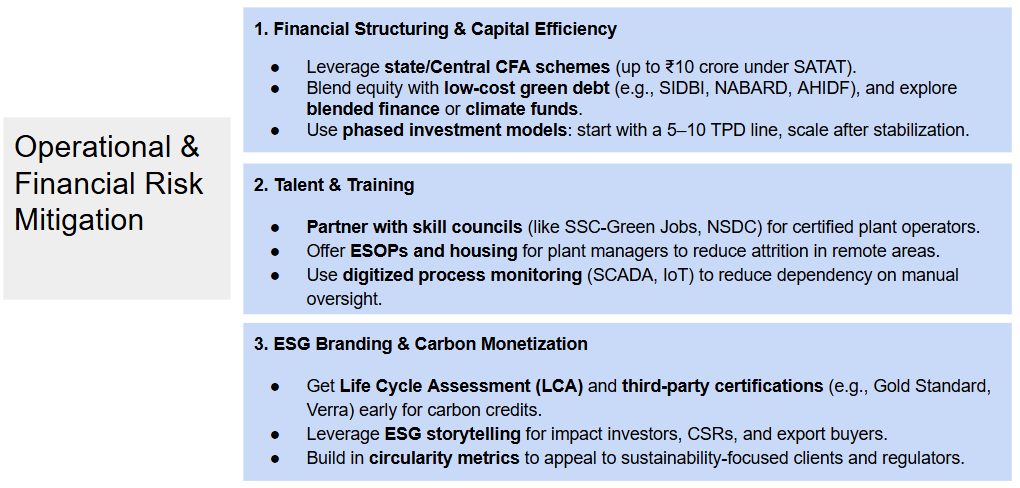

Risk Mitigation Strategies for Investors

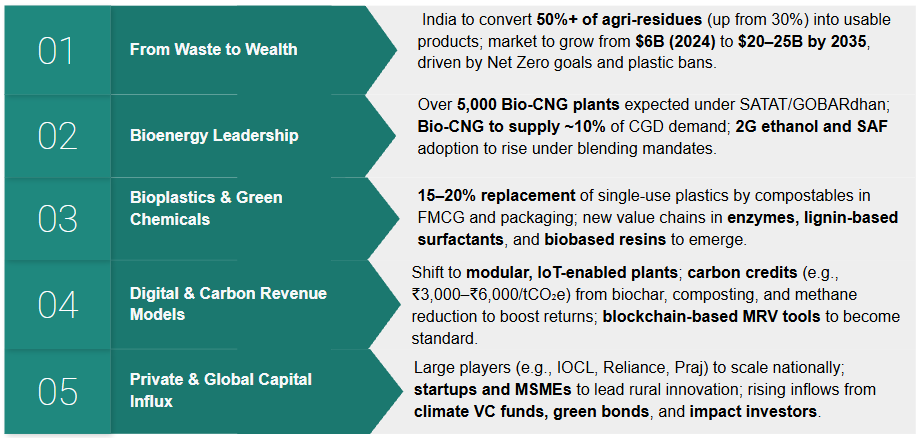

Future Outlook – Agri Waste to Value Sector (By 2035)

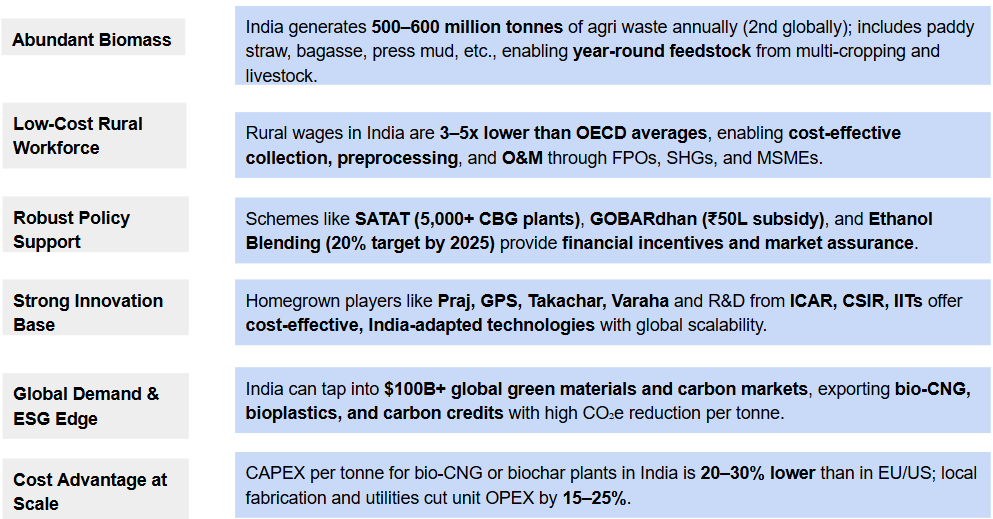

India’s Competitive Advantage in Agri Waste to Value

Government Support & Policies for Agri Waste to Value Manufacturing

- SATAT Scheme: Targets 5,000 Bio-CNG plants; offers long-term offtake to OMCs and DPR facilitation.

- GOBARdhan Scheme: Provides capital subsidy up to ₹50 lakh per plant for rural biogas/CBG from agri & cattle waste.

- National Bio-Energy Programme (MNRE): Offers CFA up to ₹10 crore and Viability Gap Funding (VGF) for bio-CNG & biomass energy projects.

- Ethanol Blending & PM-JI-VAN Yojana: Aims for 20% blending by 2025; offers 6% interest subvention and VGF for 2G ethanol plants.

- National Programme on Organic Farming (NPOF): Gives 25% capital subsidy (max ₹40 lakh) for biofertilizer and compost units.

- State & Central Incentives: Include SGST refunds, land allotment, and 3% interest subvention (e.g., under AHIDF for feed plants).

Successful Agri Waste to Value Projects in India

| Company / Project | Location | Type | Investment (₹ Cr) | Capacity | Key Outcomes |

|---|---|---|---|---|---|

| EverEnviro (Jindal Group) | Madhya Pradesh (MP) | Bio-CNG (SATAT) | ₹100 Cr+ | 100 TPD agri-waste → 10 TPD CBG | One of India’s largest CBG plants; OMC offtake under SATAT. |

| IndianOil + GPS Renewables | Namakkal, TN | Bio-CNG from press mud | ₹20 Cr | 35 TPD feedstock → 2.5 TPD CBG | Public-private model; OMC procurement guaranteed. |

| Praj Industries (2G Ethanol) | Panipat, Haryana | 2G Ethanol (Rice Straw) | ₹900 Cr (by IOCL) | 100 KLPD (1 lakh litres/day) | Commissioned in 2022; supports India’s 20% ethanol blending goal. |

| Takachar + IIT Delhi | Delhi (pilot stage) | Biochar from crop waste | ₹2–3 Cr (seed funded) | ~5 TPD (modular tech) | Scalable decentralized tech; won Earthshot Prize (UK, 2021). |

| Kisan Agri Bio Energy | Kolhapur, Maharashtra | Biogas from cane trash | ₹7.5 Cr | 50 TPD → 3 TPD biogas, 2 T compost | Farmer-led model with offtake to sugar mills and local users. |

| EnviGreen | Bengaluru, Karnataka | Bioplastics (bags) | ₹3–4 Cr | 0.5–1 TPD of compostable bags | Exports to SE Asia; scalable and fully biodegradable bags. |

| CarbonCraft + BiocharIND | Gujarat & Bihar | Biochar (for carbon credit) | ₹100–120 Cr | 100 TPD biomass → 25 TPD biochar | Integrated with carbon markets; targets CO₂ removal at scale. |

MOVING FORWARD

- India offers a rare convergence of abundant biomass, low-cost operations, strong policy backing, and rising ESG-driven demand.

- With market size expected to reach $20–25 billion by 2035, early investors can capture value across energy, materials, and carbon markets.

- Government support through subsidies, assured offtake, and interest subvention reduces risk and accelerates breakeven.

- While feedstock aggregation, tech validation, and regulatory delays remain key challenges, they can be mitigated through strategic partnerships, modular scaling, and carbon-linked business models.

- Successful case studies across India prove that returns of 18–30% IRR are achievable in well-executed projects.

- This is not just an environmental opportunity—it’s a profitable, impact-driven investment frontier poised for scale.

Wish to have industry or market research support from specialists for climate & environment? Talk to EAI team – Call Muthu at +91-9952910083 or send a note to consult@eai.in

Our specialty focus areas include

Our specialty focus areas include