Strategic Insights Report: Solar Inverters

About Us

Energy Alternatives India (EAI)

India’s leading catalyst for climate tech since 2008.

▶ Domains: Renewable energy | Low-carbon mobility | Sustainable materials | Clean environment

▶ Services:

• Strategic & market intelligence

• Startup & innovation ecosystem support

• Geo-targeted decarbonization solutions

Net Zero by Narsi

Insights and interactions on climate action by Narasimhan Santhanam, Director - EAI

View full playlist▶ Track Record: Solar, biomass, decarbonization, biofuels, green chemicals and more.

→ Powering India’s sustainable growth & climate action

→ Assisted 100+ companies including JSW Energy, ExxonMobil, Vedanta, GE, GSW…

Introduction

Solar inverters are a critical component of any solar energy system—they convert the direct current (DC) generated by solar panels into alternating current (AC) that can be used by homes, industries, and the grid. As India rapidly expands its solar capacity, the demand for reliable and efficient inverters has grown significantly.

India’s inverter market is evolving with a mix of domestic and global manufacturers, catering to a wide range of applications—from residential rooftops to utility-scale solar farms. The Indian government’s ambitious goal of 280 GW of solar power by 2030, along with incentives like the PLI scheme and domestic content mandates, has further accelerated local manufacturing.

The country is witnessing a shift from traditional central inverters to more advanced string, hybrid, and smart inverters equipped with monitoring, grid compliance, and battery integration capabilities. With increasing focus on efficiency, grid stability, and digital energy management, solar inverters are becoming not just power converters but intelligent control systems for the future energy ecosystem.

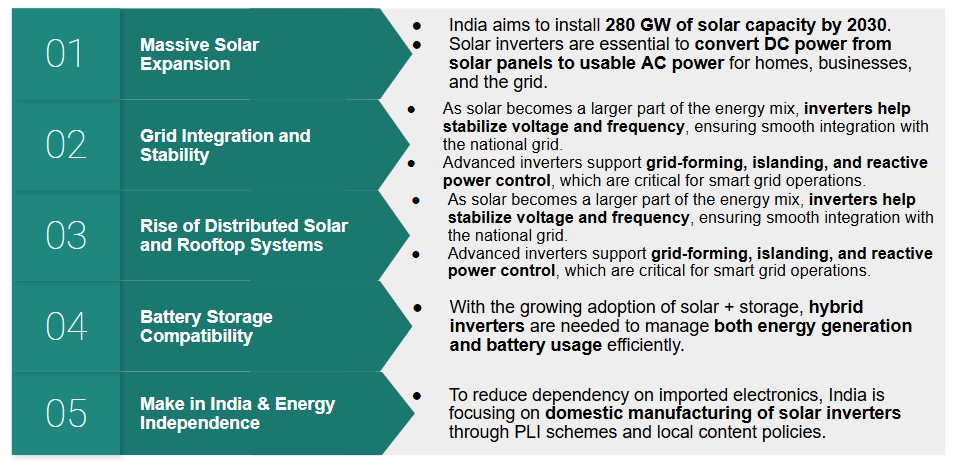

Why India Needs Solar Inverters Now

Massive Solar Expansion

- India aims to install 280 GW of solar capacity by 2030.

- Solar inverters are essential to convert DC power from solar panels to usable AC power for homes, businesses, and the grid.

Grid Integration and Stability

- As solar becomes a larger part of the energy mix, inverters help stabilize voltage and frequency, ensuring smooth integration with the national grid.

- Advanced inverters support grid-forming, islanding, and reactive power control, which are critical for smart grid operations.

Rise of Distributed Solar and Rooftop Systems

- Rooftop and small-scale solar installations require string and hybrid inverters that can manage local loads, batteries, and smart metering.

Battery Storage Compatibility

- With the growing adoption of solar + storage, hybrid inverters are needed to manage both energy generation and battery usage efficiently.

Make in India & Energy Independence

- To reduce dependency on imported electronics, India is focusing on domestic manufacturing of solar inverters through PLI schemes and local content policies.

Why India Needs Solar Inverters Now

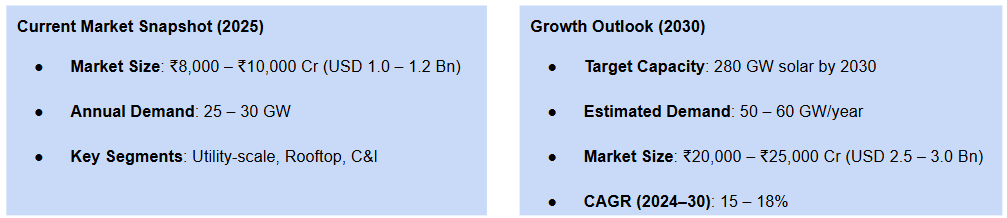

Solar Inverter Market in India: Size & Growth Potential

Key Growth Drivers:

- Surge in Utility-Scale & Rooftop Solar Projects: Rooftop solar (especially C&I) is witnessing strong adoption due to rising electricity costs and net metering benefits, fueling demand for string and hybrid inverters.

- Shift Toward Hybrid Systems with Energy Storage: Growing interest in solar + battery setups in both urban and rural areas requires hybrid inverters that can manage energy storage, grid feed-in, and backup simultaneously. This trend is further accelerated by increasing power reliability concerns and government schemes promoting distributed energy storage.

- Government Push for Domestic Manufacturing & Smart Grids: The PLI Scheme, import duties, and ALMM mandates are encouraging local inverter production, reducing reliance on imports. Meanwhile, the push for smart grids and digital energy management is boosting demand for AI-integrated, IoT-enabled smart inverters that allow remote monitoring, diagnostics, and grid interaction.

Types of Solar Inverters in India

| Type | Description | Used In | Power Range | Key Features |

|---|---|---|---|---|

| String Inverter | Connects a series (string) of solar panels; each string has its own inverter | Rooftop, C&I, small utility | 1 kW – 350 kW | High efficiency, easy maintenance, cost-effective |

| Central Inverter | One large inverter handles multiple strings; used for high-capacity solar plants | Utility-scale solar farms | 250 kW – 5 MW+ | High power handling, low cost per watt, bulky |

| Microinverter | Installed behind each panel; converts DC to AC at panel level | Residential rooftops | 250 W – 1.5 kW | Maximizes panel output, ideal for shaded roofs |

| Hybrid Inverter | Works with both solar panels and batteries; can feed excess to the grid | Homes, C&I, off-grid areas | 3 kW – 30 kW+ | Manages solar + battery + grid, supports storage |

| Multimode Inverter | Combines string/hybrid features; supports grid-tied, off-grid & backup modes | Smart homes, C&I, telecom towers | 5 kW – 100 kW | High flexibility, automatic switching, intelligent control |

Competitive Landscape – Solar‑Inverter Manufacturing in India

| Rank (2024) | Manufacturer (Local Factory) | Indian Plant Capacity | Key Product Focus | 2024 Market‑Share Snapshot |

|---|---|---|---|---|

| 1 | Sungrow India – Bengaluru | 10 GW / yr (string + central) | 352 kW string, “1 + X” modular central inverters | 29% total, 45% of central segment |

| 2 | TBEA Energy India – Vadodara | 2 GW / yr capacity (string & central) | 250–350 kW string inverters | 21% total, 34% of string segment |

| 3 | Sineng Electric India – Bengaluru | 10 GW / yr (expanded 2021) | 352 kW string & 4.4 MVA central | 13% total supply |

| 4 | FIMER India (ex‑ABB) – Bengaluru | 5 GW / yr multi‑line | 5 MVA central, 125–250 kW string | 12% total; 25% of central segment |

| 5 | Ginlong Solis – contract assembly | <1 GW (string) | Residential & C&I string range | 6% total, 11% of string segment |

| 6 | Hitachi Hi‑Rel – Sanand, GJ | ≈2.5 GW / yr | 1500 V central inverters | <1% share but growing in niche tenders |

Setting Up a Solar Inverter Manufacturing Plant in India

| Segment | Minimum Viable Capacity | Suitable Use Case |

|---|---|---|

| Residential String Inverters | 100–200 MW/year | Rooftop, off-grid, small-scale |

| C&I String Inverters | 500 MW/year | Rooftop, MSME, urban demand |

| Utility-Scale String Inverters | 1–2 GW/year | Large-scale solar farms |

| Central Inverters | >1 GW/year | Utility-scale, EPC contractors |

| Technology Type | Minimum Viable Capacity | Estimated CapEx (INR) | Key Equipment Includes |

|---|---|---|---|

| String Inverter – Basic Line | 200 MW/year | ₹25 – ₹35 Cr | SMT lines, PCB assembly, test benches |

| String Inverter – GW Scale | 1 GW/year | ₹80 – ₹100 Cr | Fully automated lines, high-speed testers, EMS |

| Central Inverter Line | 1 GW/year | ₹100 – ₹125 Cr | High-power transformer test bays, load simulators |

| Hybrid Inverter (Battery-Ready) | 500 MW/year | ₹40 – ₹50 Cr | Additional BMS integration, thermal design tools |

| Full-stack Design + R&D + Assembly | 1 GW/year | ₹150 Cr+ | Internal R&D lab, EMI/EMC compliance, software development |

Investor Metrics – Solar Inverter Manufacturing in India (2025 Estimates)

| Plant Type | Capacity | CapEx (INR Cr) | IRR (%) | ROI (5 Yrs) | Payback Period |

|---|---|---|---|---|---|

| Basic String Inverter Line | 200 MW/year | ₹25 – ₹35 Cr | 16–20% | 1.7x – 2.2x | 3.5 – 4 years |

| GW-Scale String Inverter Plant | 1 GW/year | ₹80 – ₹100 Cr | 20–24% | 2.2x – 2.8x | 3 – 3.5 years |

| Central Inverter Line | 1 GW/year | ₹100 – ₹125 Cr | 18–22% | 1.9x – 2.5x | 3.5 – 4 years |

| Hybrid Inverter (with R&D) | 500 MW/year | ₹40 – ₹50 Cr | 21–25% | 2.5x – 3.0x | 3 – 3.5 years |

| Full-Stack Smart Inverter Plant | 1 GW + R&D + IoT | ₹150 – ₹180 Cr | 22–26% | 2.5x – 3.2x | 3 – 4 years |

Insights:

- Small-scale string inverter plants (₹25–35 Cr) offer quick entry but lower IRR and limited scale competitiveness.

- GW-scale string/hybrid plants deliver stronger IRR and ROI due to economies of scale, better pricing power, and faster breakeven.

Hybrid and smart inverter lines with storage/IoT integration attract higher margins and faster payback, especially as demand shifts toward energy intelligence and grid interaction.

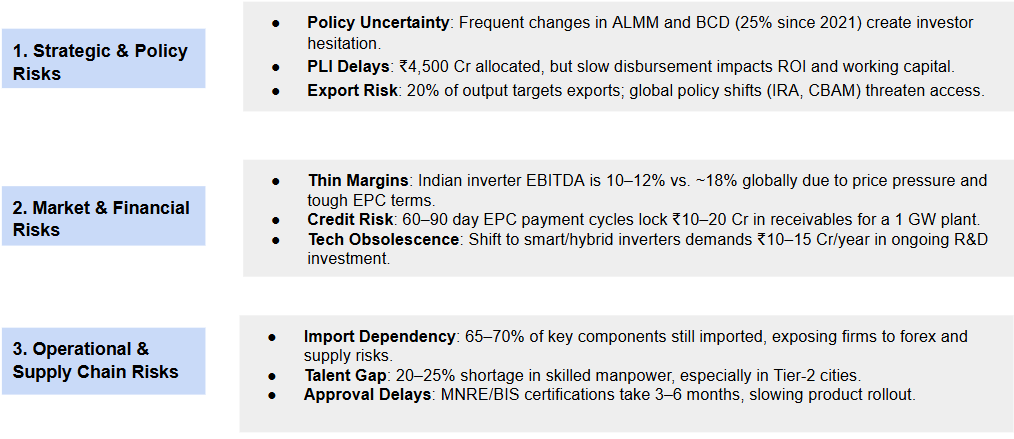

Challenges in Solar Inverter Manufacturing in India

Future Outlook of Solar Inverter Manufacturing in India

- Explosive Demand Growth

- India is expected to deploy 280 GW of solar by 2030, with inverter demand projected to reach 50–60 GW/year by 2030.

- Rooftop solar, distributed generation, and C&I sectors will drive significant growth in string and hybrid inverters.

- Shift Toward Smart & Hybrid Inverters

- By 2030, over 60% of new inverters will be hybrid-enabled (battery + grid + solar), supporting energy storage, EV charging, and real-time load management.

- AI/IoT-integrated inverters will become standard, allowing remote diagnostics, predictive maintenance, and dynamic grid interaction.

- Strong Push for Local Manufacturing

- With PLI schemes, import duties, and the “Atmanirbhar Bharat” vision, India is expected to localize over 80% of its inverter supply chain by 2030.

- Indian plants will be capable of 10–15 GW/year each, targeting both domestic and export markets (especially US, EU, Africa, MENA).

- Export Opportunity under “China+1” Strategy

- Global developers are seeking non-China supply post-COVID and trade tensions.

- Indian firms with UL/IEC certifications are well-positioned to capture a share of the $10+ billion global inverter market by 2035.

- Consolidation & Tech-Led Competition

- The market will consolidate around 5–6 players with large-scale, vertically integrated operations.

- Winners will combine low-cost manufacturing with cutting-edge technology, software control, and after-sales service capabilities.

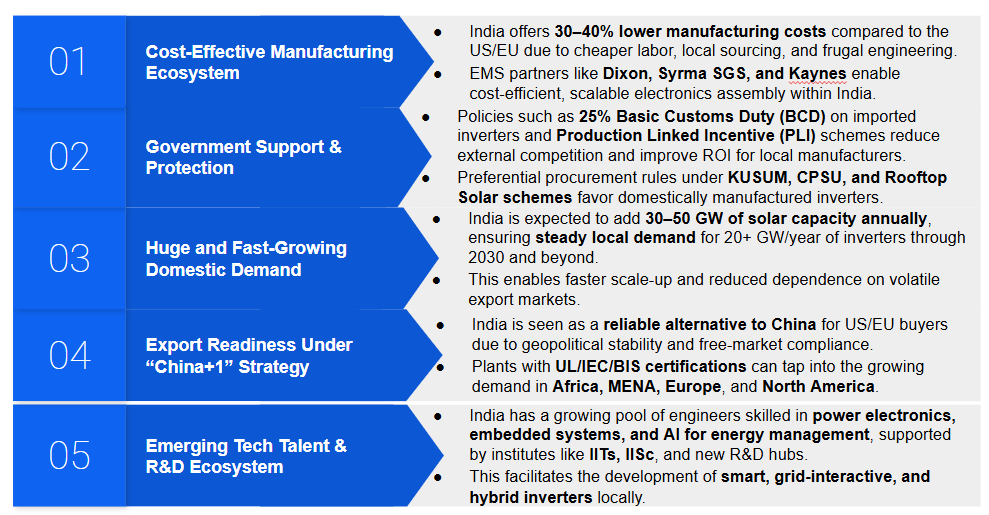

India’s Competitive Advantage in Solar Inverter Manufacturing

Government Support & Policies for Solar Inverter Manufacturing in India

- Production Linked Incentive (PLI) Scheme

- PLI for High-Efficiency Solar Components includes inverters as eligible products.

- Provides financial incentives linked to sales and efficiency improvements, with payouts up to ₹4,500 Cr across solar value chain players.

- Basic Customs Duty (BCD) Protection

- 25% BCD imposed on imported solar inverters since 2021 to promote domestic manufacturing.

- Protects Indian manufacturers from low-cost Chinese imports and encourages localization of assembly lines.

- Preference in Public Sector Tenders

- Tenders under KUSUM, CPSU, and SECI schemes require domestically manufactured inverters.

- Public-sector EPCs must source inverters from ALMM-listed Indian suppliers, improving order visibility.

- Electronics & Component Manufacturing Boost

- Under Make in India and Digital India, inverter-related electronics (PCB, controllers) qualify for incentives like Modified Electronics Manufacturing Clusters (EMC 2.0) and SPECS (up to 25% capital subsidy on components).

- Export Promotion & Certifications

- Government facilitates access to UL, IEC, BIS certifications via testing labs and subsidies under National Programme on High Efficiency Solar PV Modules.

- Inverters with these approvals can access US and EU export markets, supported by India’s FTAs and non-tariff compliance roadmap.

Successful Solar Inverter Manufacturers in India

| Company | Indian Plant Capacity | Tech Focus | Key Projects & Clients | Success Highlights |

|---|---|---|---|---|

| Sineng Electric India | 10 GW/year | Central (4.4 MVA), String (352 kW), Hybrid | NTPC, Adani, ReNew, Tata Power | Localized 80%+, 10 GW+ shipped, exports to MEA & Africa, full-stack R&D in India |

| Sungrow India | 10 GW/year | Central Modular (1+X), Utility String | Ayana, JSW Energy, Azure Power | #1 market share (29% in 2024), deep EPC ties, large-scale local plant in Bengaluru |

| FIMER India (ex-ABB) | 5 GW/year | Central (5 MVA), C&I String | NTPC, Jakson, Amplus, L&T | Legacy brand trust, Make-in-India early mover, central inverters for mega projects |

| TBEA Energy India | ~2 GW/year | Utility-grade String (250–350 kW), Central | SECI tenders, NTPC, state utilities | Targeted utility segment, strong in EPC-backed deployments, advanced transformer R&D |

| Hitachi Hi-Rel | ~2.5 GW/year | 1500V Central Inverters | NTPC, SJVN, BHEL, CPWD | Indian-origin player, niche PSU tenders, premium reliability image |

| Ginlong Solis (India) | <1 GW (contract-based) | Residential & Rooftop String (3–50 kW) | Tata Power Solar, rooftop integrators | Fast-growing in residential, strong brand, limited local assembly |

MOVING FORWARD

Based on the successful examples of players like Sineng, Sungrow, FIMER, and Hitachi Hi-Rel, it is clear that India offers a robust and fast-growing ecosystem for solar inverter manufacturing, supported by:

- Strong policy incentives (PLI, BCD, public tender preference)

- Rapid domestic demand growth (expected to cross 50–60 GW/year by 2030)

- Emerging export potential under the “China+1” supply diversification strategy

Investors who establish ≥1 GW/year smart or hybrid inverter plants, backed by local R&D, strong EPC partnerships, and compliance with BIS/IEC/UL standards, are well-positioned to achieve:

- Attractive IRRs (20–25%)

- 2.2x–3.2x ROI over 5 years

- Payback in 3–4 years

India’s solar inverter manufacturing sector presents a compelling investment opportunity for those willing to build at scale, integrate innovation, and align with government and export demand — making it a high-potential play in the global clean energy value chain.

Wish to have industry or market research support from specialists for climate & environment? Talk to EAI team – Call Muthu at +91-9952910083 or send a note to consult@eai.in

Our specialty focus areas include

Our specialty focus areas include