Strategic Insights Report: Solar Cells

About Us

Energy Alternatives India (EAI)

India’s leading catalyst for climate tech since 2008.

▶ Domains: Renewable energy | Low-carbon mobility | Sustainable materials | Clean environment

▶ Services:

• Strategic & market intelligence

• Startup & innovation ecosystem support

• Geo-targeted decarbonization solutions

Net Zero by Narsi

Insights and interactions on climate action by Narasimhan Santhanam, Director - EAI

View full playlist▶ Track Record: Solar, biomass, decarbonization, biofuels, green chemicals and more.

→ Powering India’s sustainable growth & climate action

→ Assisted 100+ companies including JSW Energy, ExxonMobil, Vedanta, GE, GSW…

Introduction

Solar cells, also known as photovoltaic (PV) cells, are devices that convert sunlight directly into electricity through the photovoltaic effect. They are the fundamental building blocks of solar panels and play a critical role in harnessing renewable energy from the sun.

As global energy markets shift toward sustainability, solar energy has emerged not just as an environmental choice, but as a strategic and financially sound investment. At the heart of this revolution are solar cells—the technology that converts sunlight into electricity.

Today, solar power offers predictable energy costs, reduces dependency on volatile fossil fuel markets, and aligns with ESG goals and carbon neutrality targets. Moreover, innovations and declining costs are rapidly improving ROI and scalability.

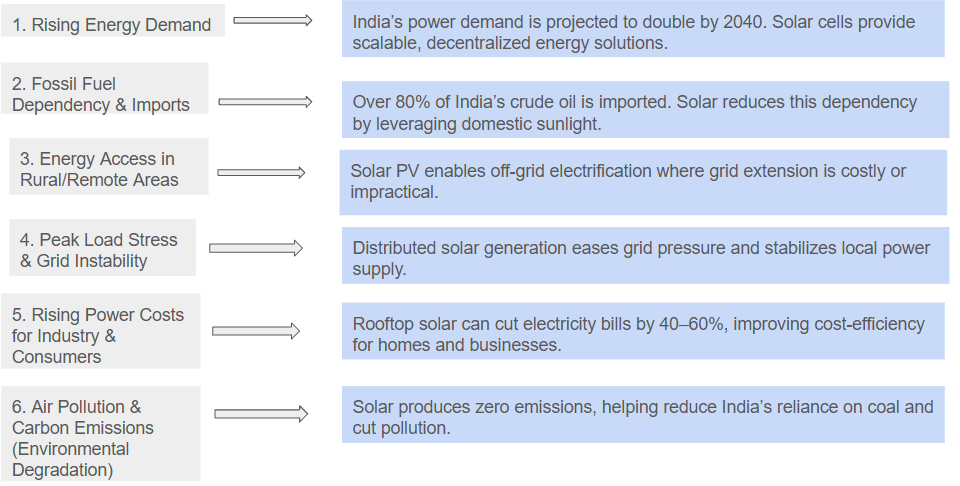

Problem Statement Solar Cells Will Solve in India

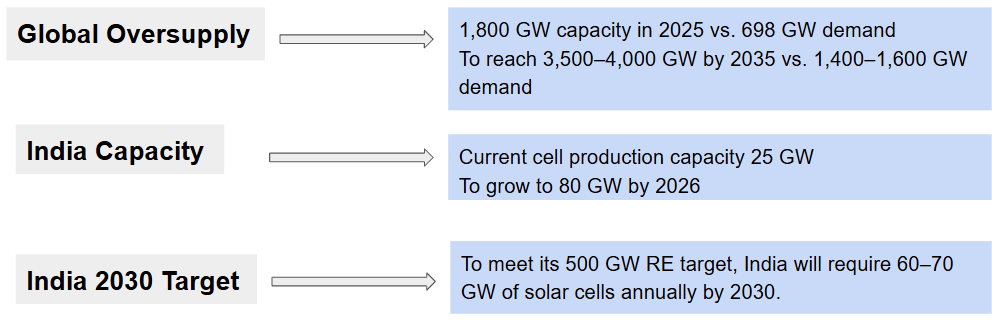

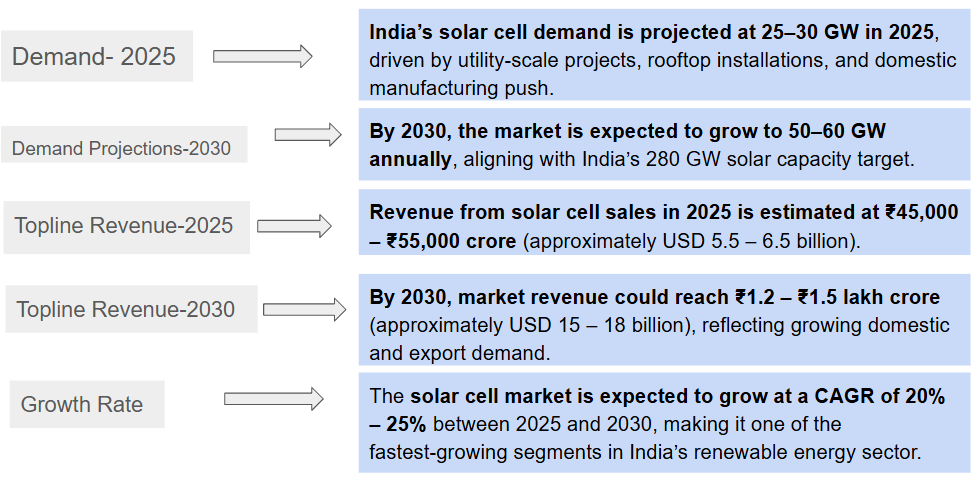

Solar Cell Market Dynamics

Types of Solar Cells

| Type | Material & Technology | Efficiency Range | Typical Cost (₹/Watt) | Lifespan | Key Features |

|---|---|---|---|---|---|

| Monocrystalline Silicon | Single-crystal silicon | 20% – 24% | ₹22 – ₹28 | 25 – 30 years | High efficiency and space-saving; ideal for rooftops and premium projects |

| Polycrystalline Silicon | Multi-crystal silicon | 15% – 18% | ₹18 – ₹24 | 20 – 25 years | Cost-effective; widely used in utility-scale solar projects |

| Thin-Film (CdTe, a-Si, CIGS) | Amorphous or layered semiconductors | 10% – 14% | ₹16 – ₹22 | 15 – 20 years | Lightweight and flexible; suitable for BIPV and large surfaces |

| PERC (Mono/Poly) | Passivated Emitter Rear Contact (enhanced Mono/Poly) | 21% – 23% | ₹23 – ₹29 | 25+ years | Improved yield and performance in low-light; increasingly mainstream |

| TOPCon | Tunnel Oxide Passivated Contact with advanced mono silicon | 22% – 25% | ₹26 – ₹32 | 30 years | Higher efficiency and lower degradation; replacing PERC in new setups |

| HJT (Heterojunction) | Hybrid of crystalline and thin-film silicon technologies | 22% – 26% | ₹30 – ₹36 | 30+ years | High efficiency, better temperature performance; ideal for premium segments |

| Perovskite (Emerging) | Perovskite-structured materials | 20% – 28% (potential) | ₹15 – ₹20 (expected, not commercial yet) | Under development | Low-cost and printable; future potential in flexible, light-weight modules |

| Organic PV (OPV) | Organic polymers or molecules | 5% – 12% | ₹10 – ₹15 (lab scale) | 10 – 15 years | Ultra-light and flexible; suitable for niche portable applications |

Market Size & Growth Potential

Competitive Landscape Of Solar Cell Manufacturing in India

- Top Players: Waaree, Tata Power Solar, Adani Solar, Reliance New Energy, and Emmvee lead the domestic market, with planned or operational cell capacities ranging from 2.5 GW to 10 GW.

- Rapid Capacity Expansion: India’s solar cell manufacturing capacity is projected to grow from ~10 GW (2023) to over 50 GW by FY2027, driven by the ₹24,000 crore PLI scheme and domestic content mandates.

- Technology Shift: Players are moving rapidly from PERC to advanced technologies like TOPCon and HJT to stay globally competitive and improve efficiency.

- Vertical Integration: Large players like Adani and Reliance are building fully integrated facilities (quartz-to-module), reducing dependence on imports and improving cost control.

- Margin Pressure & Price War: Despite growth, the market faces intense price competition, falling ASPs, and margin compression—only players with scale, automation, and efficient supply chains are likely to stay profitable.

Financial Returns of Solar Cell Manufacturing Plants in India

| Type of Plant | Capacity | Estimated CapEx | ROI (5-Year Avg) | IRR | Payback Period |

|---|---|---|---|---|---|

| Polycrystalline Cell Plant | 500 MW/year | ₹600 – ₹750 Cr | ~12–14% | 13–15% | 6–7 years |

| Mono PERC Cell Plant | 1 GW/year | ₹1,000 – ₹1,200 Cr | ~15–18% | 17–20% | 4.5 – 6 years |

| TOPCon Cell Plant | 1 GW/year | ₹1,200 – ₹1,400 Cr | ~18–20% | 20–24% | 4 – 5 years |

| HJT Cell Plant (High Efficiency) | 1 GW/year | ₹1,500 – ₹1,700 Cr | ~20–23% | 22–26% | 3.5 – 4.5 years |

| Fully Integrated Fab (Polysilicon to Cell) | 5 GW/year | ₹8,000 – ₹10,000 Cr | ~25%+ | 28–32% | 3 – 4 years |

Prominent Indian Companies & Partnerships

| Company | Business/Manufacturing Partnerships | Marketing/Distribution Partnerships | Technology/R&D Partnerships |

|---|---|---|---|

| Waaree Energies | • SB Energy (USA): Multi-GW module supply for U.S. projects • 3 GW Texas facility: Cell + module plant (operational 2025) |

• Exports to 68+ countries • 360+ Indian service centers |

• NVIDIA: AI-driven defect detection in production |

| Vikram Solar | • VSK Energy LLC (USA): $1.5B JV for 4 GW module plant in Colorado • Gujarat State Electricity Corp: 326.6MW module supply for Khavda Solar Park |

• Fraunhofer ISE (Germany): TOPCon cell efficiency R&D | |

| Adani Solar | • 10 GW vertical integration: In-house polysilicon-to-module ecosystem (Gujarat) • 20 GW solar park: Partnership with Gujarat government |

• ISC Konstanz (Germany): Back-contact cell R&D | |

| Tata Power Solar | • REC Silicon (Norway): Polysilicon procurement | • 40% rooftop market share via Tata Group retail channels | • IIT Bombay: Perovskite tandem cell prototyping |

| Premier Energies | • Sino-American Silicon (Taiwan): 74:26 JV for 2 GW wafer plant in India • Heliene Inc. (USA): 1 GW cell plant JV (scaled down due to tariffs) • $150M IPO: Fundraising for 5 GW capacity expansion |

• TOPCon module R&D for U.S. market | |

| Goldi Solar | • 14 GW automated factory: AI-powered production | • Exports to 20+ countries (EU/Africa focus) | • NVIDIA: AI vision for micro-crack detection |

| RenewSys | • Reliance Industries: Backward integration (encapsulants/backsheets) | • DuPont: Certified Tedlar® backsheet distribution | • Proprietary POE encapsulant for humidity resistance |

| Saatvik Green Energy | • REC Wafer (Norway): Long-term wafer supply agreement | • Targeting 7–8 GW exports to North America/Europe | • HJT pilot line (24.7% efficiency) |

| Avaada Group | • $443M funding from Japan Bank: For 6.5 GW module line • UAE MoU: 6 GW module export pipeline |

• IIT Delhi: Silicon recycling technology | |

| Loom Solar | • 3,500+ rural dealers: D2C network | • PM Surya Ghar Muft Bijlee Yojana: Govt. subsidy program partner | • Lithium battery integration for off-grid solutions |

Challenges & Threats to Solar Cell Manufacturing in India

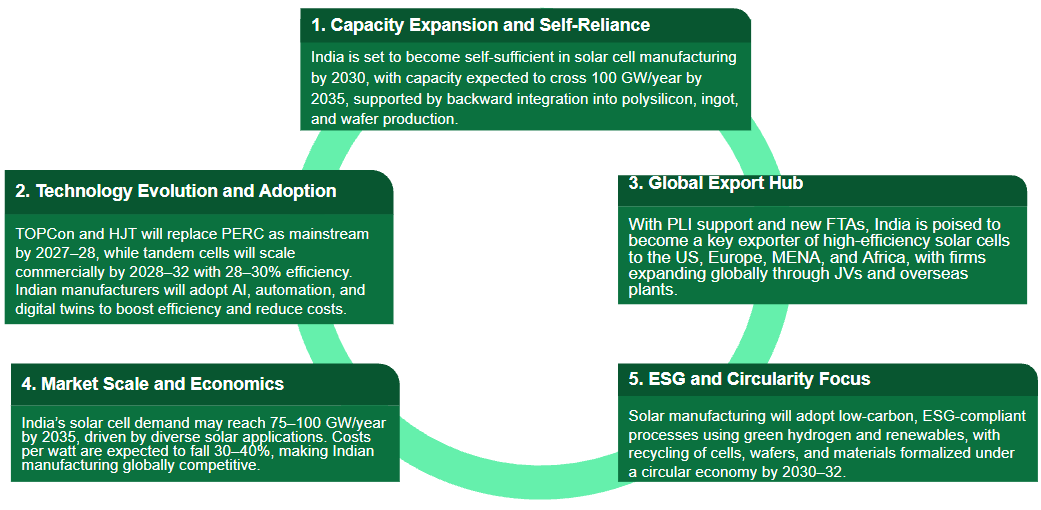

Future Outlook of Solar Cell Manufacturing in India

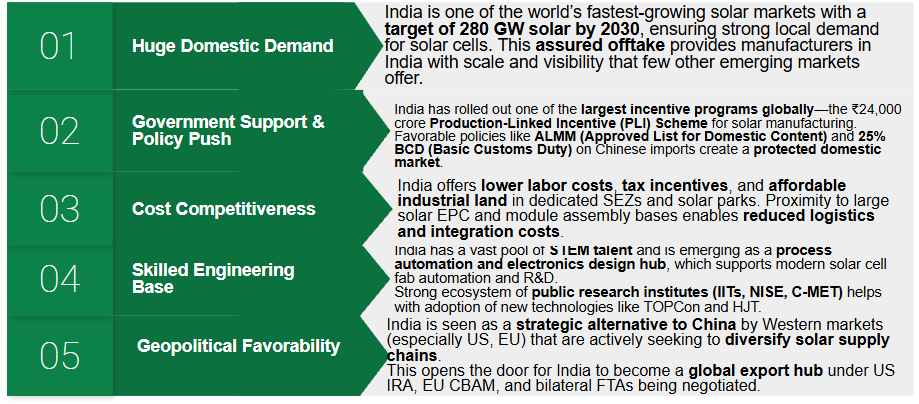

India’s Strategic Advantages in Solar Cell Manufacturing

Government Support & Policies for Solar Cell Manufacturing in India

- PLI Scheme (₹24,000 cr) – pays performance‑linked incentives for high‑efficiency cells/modules; aims for 48 GW fully‑integrated capacity by 2027; beneficiaries include Reliance, Adani, Tata Power Solar, Waaree, ReNew, etc.

- Import Duties – 25 % BCD on cells, 40 % on modules (since Apr 2022) shields local makers from low‑priced Chinese imports.

- ALMM Mandate – only Indian‑listed manufacturers may supply modules (and soon cells) to government or DISCOM projects, ensuring a captive domestic market.

- Domestic Content Requirements – schemes like KUSUM and Rooftop Solar‑II require India‑made cells/modules for projects receiving central subsidies.

- State & Infra Incentives – SEZ/solar‑park land, power‑tariff concessions, capex subsidies, and low‑interest loans via IREDA reduce set‑up costs.

- Export & Trade Strategy – India’s China‑plus‑one positioning, green‑tech FTAs (EU, UK, UAE) and IRA‑driven US demand create a growing export pathway for Indian‑made high‑efficiency cells.

Solar Cell investments by Tata, Waaree, Adani and Reliance

| Company | Capacity (Cell & Module) | Investment | Technology | Location |

|---|---|---|---|---|

| Tata Power | 4.3 GW (Cell & Module) | ₹3,000 crore (~$360 million) | Mono PERC & TOPCon | Tirunelveli, Tamil Nadu |

| Waaree Energies | 5.4 GW (Cell), 13.3 GW (Module) | ₹3,000 crore (~$360 million) | PERC & TOPCon | Chikhli, Gujarat |

| Adani Group | 10 GW (Planned by 2027) | ₹30,000 crore (~$3.6 billion) | Multiple | Mundra, Gujarat |

| Reliance Industries | 10 GW (Expandable to 20 GW) | $10 billion (across clean energy) | HJT & Integrated PV | Jamnagar, Gujarat |

MOOVING FORWARD

Capitalize on India’s Production Linked Incentive (PLI) scheme to reduce upfront manufacturing costs and ensure long-term profitability in solar cell manufacturing.

Leverage government support such as ALMM mandates and customs duty protection to ensure market preference for domestically manufactured cells.

Establish partnerships with EPC players and state DISCOMs to secure offtake agreements and long-term supply contracts.

Invest in high-efficiency solar technologies like TOPCon, HJT, and perovskite tandem cells to differentiate in a competitive market and future-proof operations.

Target emerging export markets in the Middle East, Africa, and Southeast Asia to diversify revenue streams beyond India.

Optimize value chain control by integrating backward into ingot/wafer production or forward into module assembly to capture greater margins.

Tap into green financing instruments and sustainability-linked bonds to lower the cost of capital while aligning with ESG mandates.

Wish to have industry or market research support from specialists for climate & environment? Talk to EAI team – Call Muthu at +91-9952910083 or send a note to consult@eai.in

Our specialty focus areas include

Our specialty focus areas include