Why is the Indian Bioplastics Market an Attractive Destination for International Investment ?

The Indian bioplastics market has emerged as an attractive destination for international investment due to several factors:

- Growing Demand: India’s rapidly growing population and increasing consumer awareness about environmental issues have led to a rising demand for sustainable alternatives to traditional plastics. According to a report by Grand View Research, the Indian bioplastics market size was valued at USD 188.5 million in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 17.5% from 2020 to 2027.

- Government Initiatives: The Indian government has been actively promoting the use of bioplastics as part of its efforts to reduce plastic pollution and achieve sustainability goals. Initiatives such as the Plastic Waste Management Rules, 2016, and the ban on single-use plastics in certain states have created a conducive environment for the growth of the bioplastics industry.

- Investment in Research and Development: Indian companies and research institutions are investing in research and development to develop innovative bioplastic materials that are cost-effective and environmentally friendly. For example, the Indian Institute of Technology (IIT) Kharagpur has developed biodegradable plastic bags using natural polymers.

- Abundant Raw Materials: India has abundant sources of raw materials for bioplastic production, including sugarcane, corn, and other agricultural residues. This availability of feedstock at competitive prices provides a cost advantage for bioplastic manufacturers in India.

- Market Potential: With a large consumer base and increasing environmental consciousness among consumers, India offers significant market potential for bioplastics. Companies such as Novamont, NatureWorks LLC, and BASF are already investing in the Indian market to capitalize on this potential.

- Infrastructure Development: The Indian government’s focus on infrastructure development, including waste management and recycling facilities, supports the growth of the bioplastics industry by providing necessary infrastructure for collection, processing, and disposal of bioplastic products.

- Partnerships and Collaborations: International companies are forming partnerships and collaborations with Indian firms to leverage their expertise and access the Indian market. For example, in 2019, Total Corbion PLA, a joint venture between Total and Corbion, inaugurated its first bioplastics plant in Thailand with plans to cater to the Indian market as well.

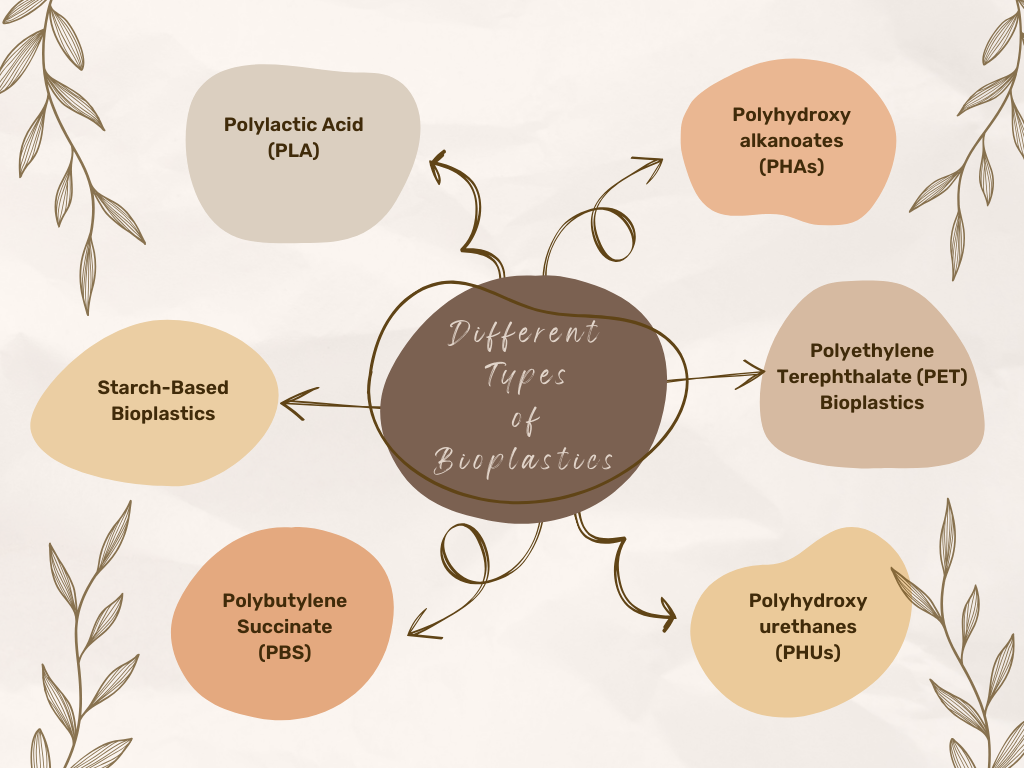

DIFFERENT TYPES OF BIOPLASTICS IN INDIA

Here are some different types of bioplastics commonly used in India:

- Polylactic Acid (PLA):

- PLA is one of the most widely used bioplastics globally and is derived from renewable resources such as corn starch or sugarcane.

- It is commonly used in packaging films, disposable tableware, and 3D printing applications.

- In India, PLA-based products are gaining popularity in various industries, including food packaging and textiles.

- Polyhydroxyalkanoates (PHAs):

- PHAs are a family of biodegradable polymers produced by microorganisms through fermentation of renewable feedstocks.

- They exhibit properties similar to conventional plastics and are used in applications such as packaging, disposable items, and agricultural films.

- In India, research and development efforts are underway to produce PHAs from agricultural waste and microbial fermentation, promoting their use in various sectors.

- Starch-Based Bioplastics:

- Starch-based bioplastics are derived from renewable starch sources such as corn, wheat, or potatoes.

- They are often blended with other biodegradable polymers to enhance mechanical properties and processability.

- Starch-based bioplastics find applications in packaging, disposable cutlery, and agricultural mulch films in India.

- Polyethylene Terephthalate (PET) Bioplastics:

- PET bioplastics are derived from renewable feedstocks such as sugarcane or corn, offering similar properties to conventional PET plastics.

- They are used in beverage bottles, food packaging, and textiles, providing a sustainable alternative to fossil fuel-based PET.

- In India, companies are exploring the production of PET bioplastics from sugarcane ethanol, contributing to the circular economy and reducing dependence on petroleum-based PET.

- Polybutylene Succinate (PBS):

- PBS is a biodegradable polyester derived from renewable resources such as succinic acid and 1,4-butanediol.

- It exhibits good mechanical properties and is used in applications such as packaging films, disposable cutlery, and agricultural applications.

- In India, research and development efforts are focused on producing PBS from agricultural waste and renewable feedstocks, aiming to promote its use in various industries.

- Polyhydroxyurethanes (PHUs):

- PHUs are biodegradable polymers derived from renewable resources such as castor oil or soybean oil.

- They offer properties such as biodegradability, mechanical strength, and thermal stability, making them suitable for packaging, coatings, and biomedical applications.

- In India, research institutions and companies are exploring the use of PHUs as sustainable alternatives to conventional plastics in various sectors.

DIFFERENT MARKET SEGMENTS WITHIN BIOPLASTICS PRODUCT PORTFOLIO

Net Zero by Narsi

Insights and interactions on climate action by Narasimhan Santhanam, Director - EAI

View full playlist

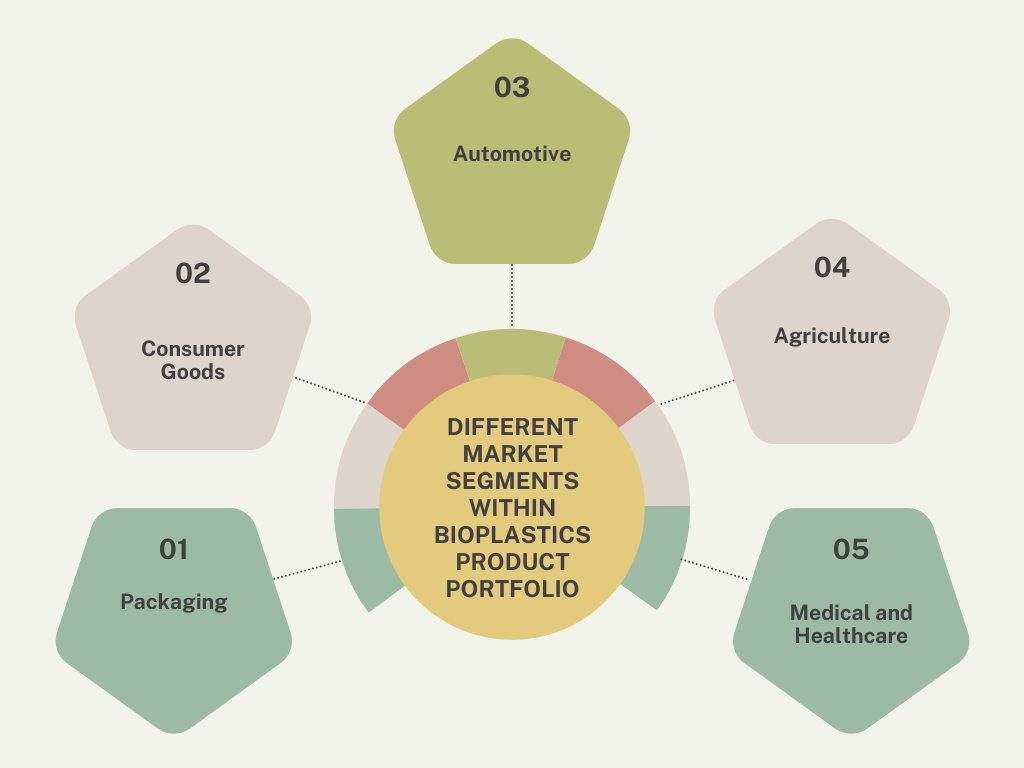

- Packaging:

- Bioplastics are widely used in packaging applications across various industries, including food and beverage, cosmetics, and consumer goods.

- Specific data points:

- According to a report by Grand View Research, the global bioplastics packaging market size was valued at $5.8 billion in 2020 and is projected to reach $24.7 billion by 2028, growing at a CAGR of 19.5% from 2021 to 2028.

- In India, the bioplastics packaging market is witnessing growth due to increasing consumer awareness about sustainable packaging options and government initiatives promoting eco-friendly materials.

- Consumer Goods:

- Bioplastics are used in the manufacturing of various consumer goods such as disposable cutlery, bags, toys, and electronics accessories.

- Specific data points:

- The global bioplastics market for consumer goods is expected to reach $13.3 billion by 2027, growing at a CAGR of 15.8% from 2020 to 2027, according to a report by Allied Market Research.

- In India, the demand for bioplastics in consumer goods is increasing as consumers become more environmentally conscious and seek sustainable alternatives to conventional plastics.

- Automotive:

- Bioplastics are utilized in automotive applications such as interior components, exterior parts, and under-the-hood components to reduce vehicle weight and improve fuel efficiency.

- Specific data points:

- The global bioplastics market for automotive applications is projected to reach $15.9 billion by 2027, growing at a CAGR of 11.2% from 2020 to 2027, according to a report by Allied Market Research.

- In India, automotive manufacturers are increasingly incorporating bioplastics in vehicle interiors and components to meet sustainability goals and regulatory requirements.

- Agriculture:

- Bioplastics are used in agricultural applications such as mulch films, pots, trays, and agricultural packaging to reduce environmental impact and promote sustainable farming practices.

- Specific data points:

- The global bioplastics market for agricultural applications is expected to reach $1.3 billion by 2027, growing at a CAGR of 6.7% from 2020 to 2027, according to a report by Allied Market Research.

- In India, the adoption of bioplastics in agriculture is increasing as farmers seek eco-friendly alternatives to conventional plastic products for crop protection and packaging.

- Medical and Healthcare:

- Bioplastics are used in medical and healthcare applications such as surgical instruments, implants, drug delivery systems, and medical packaging to ensure biocompatibility and reduce environmental impact.

- Specific data points:

- The global bioplastics market for medical and healthcare applications is projected to reach $2.4 billion by 2027, growing at a CAGR of 12.6% from 2020 to 2027, according to a report by Allied Market Research.

- In India, the demand for bioplastics in medical and healthcare applications is increasing due to stringent regulatory requirements and growing awareness about the environmental benefits of biodegradable materials in healthcare settings.

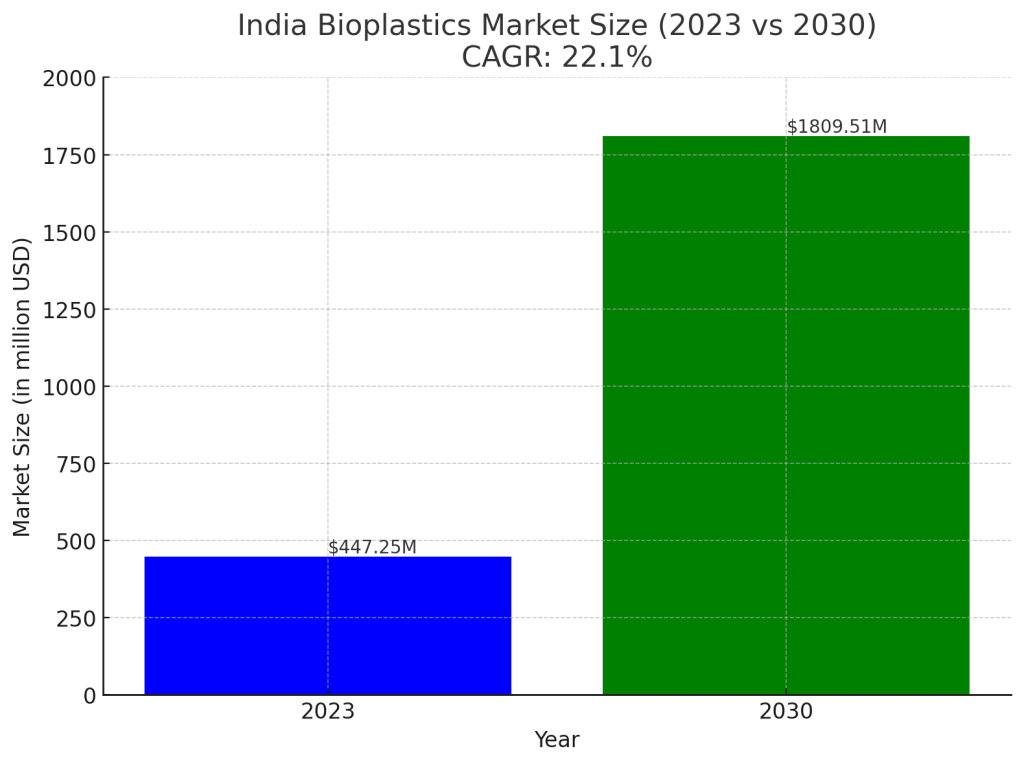

TOTAL INDIAN BIOPLASTICS MARKET SIZE

India Bioplastics Market size was valued at USD 447.25 Mn in 2023 and the India Bio Plastics Market revenue is expected to reach USD 1809.51 Mn by 2030, at a CAGR of 22.1 % over the forecast period.

GOVERNMENT POLICIES FOR BIOPLASTICS IN INDIA

| Policy/Initiative | Description | Specific Data Points |

|---|---|---|

| Plastic Waste Management Rules, 2016 | Introduced by the Ministry of Environment, Forest and Climate Change to regulate the manufacture, sale, and use of plastic products to minimize their environmental impact. | – Phasing out of non-recyclable multi-layered plastics (MLPs). – Promotion of compostable plastic bags and packaging materials. – Exemption for plastic carry bags made from compostable plastics from the ban in certain states. |

| FAME India Scheme | Launched by the Ministry of Heavy Industries and Public Enterprises to promote the adoption of electric vehicles (EVs) for reducing vehicular emissions and promoting sustainable mobility. | – Financial incentives for the purchase of EVs, including those using bioplastics, in various segments such as two-wheelers, three-wheelers, and buses under Phase II. |

| State-Specific Plastic Ban Policies | States have implemented policies to restrict the use of single-use plastics, including bioplastics, to reduce plastic pollution and promote environmental sustainability. | – Bans on single-use plastics, including bioplastics, in states like Maharashtra, Tamil Nadu, Karnataka, and Uttar Pradesh. – Encouragement of eco-friendly alternatives like biodegradable and compostable plastics. |

FAST GROWING SEGMENTS WITHIN THE INDIAN BIOPLASTICS MARKET

- Packaging:

- The packaging industry is one of the fastest-growing segments within the Indian bioplastics market.

- Specific data points:

- The Indian packaging industry is expected to reach $73.6 billion by 2022, according to a report by the Federation of Indian Chambers of Commerce and Industry (FICCI).

- The demand for biodegradable and compostable packaging materials is increasing in India due to consumer preferences for sustainable packaging solutions.

- Food Service Products:

- Bioplastics are increasingly used in food service products such as disposable cutlery, plates, cups, and food containers.

- Specific data points:

- The Indian food service packaging market is projected to grow at a CAGR of around 10% during the forecast period 2021-2026, according to a report by TechSci Research.

- The demand for bioplastics in food service products is driven by regulations banning single-use plastics and consumer preferences for environmentally friendly alternatives.

- Agricultural Films:

- Bioplastics are used in agricultural films for applications such as mulching, greenhouse covering, and crop protection.

- Specific data points:

- The Indian agricultural films market is expected to grow at a CAGR of around 8% during the forecast period 2021-2026, according to a report by IMARC Group.

- Biodegradable agricultural films made from bioplastics offer benefits such as reduced environmental impact and improved soil health, driving their adoption in India’s agriculture sector.

- Textiles:

- Bioplastics are increasingly used in the textile industry for applications such as fibers, fabrics, and non-woven materials.

- Specific data points:

- The Indian textile industry is projected to reach $350 billion by 2025, according to a report by Invest India.

- Bioplastics derived from renewable sources offer sustainable alternatives to traditional petroleum-based polymers in textile manufacturing, driving their adoption in India’s textile sector.

- Medical and Healthcare Products:

- Bioplastics are utilized in medical and healthcare products such as surgical instruments, implants, drug delivery systems, and medical packaging.

- Specific data points:

- The Indian medical devices market is expected to reach $50 billion by 2025, according to a report by Invest India.

- Bioplastics offer advantages such as biocompatibility, reduced risk of infection, and environmental sustainability, driving their use in medical and healthcare applications in India.

KEY INDIAN PLAYERS IN INDIAN BIOPLASTICS MARKET

- Eco Green Unit (EGU):

- EGU is a leading manufacturer of biodegradable and compostable bioplastics in India.

- Specific data points:

- EGU offers a wide range of bioplastic products, including bags, films, packaging materials, and cutlery, catering to various industries such as retail, hospitality, and agriculture.

- The company has a production capacity of over 5,000 metric tons per annum and exports its bioplastic products to several countries worldwide.

- Earthware Biopolymers:

- Earthware Biopolymers is a pioneer in the development and production of biodegradable bioplastics in India.

- Specific data points:

- Earthware Biopolymers manufactures a range of bioplastic products, including food packaging materials, cutlery, cups, and containers, using renewable resources such as corn starch and sugarcane bagasse.

- The company’s products are certified compostable and biodegradable, meeting international standards for eco-friendly packaging solutions.

- BioGreen Bags:

- BioGreen Bags is a prominent manufacturer and supplier of biodegradable and compostable bags and packaging materials in India.

- Specific data points:

- BioGreen Bags specializes in producing bioplastic bags, pouches, films, and packaging solutions for various industries, including retail, food service, and e-commerce.

- The company’s bioplastic products are certified by leading international organizations for their environmental sustainability and compostability.

- EnviGreen Biotech India Pvt Ltd:

- EnviGreen Biotech India Pvt Ltd is a leading innovator and manufacturer of eco-friendly bioplastic solutions in India.

- Specific data points:

- EnviGreen offers a wide range of biodegradable and compostable products, including bags, packaging materials, and disposable tableware, made from natural starch and vegetable waste.

- The company’s bioplastic products are designed to replace single-use plastics and offer sustainable alternatives for various applications.

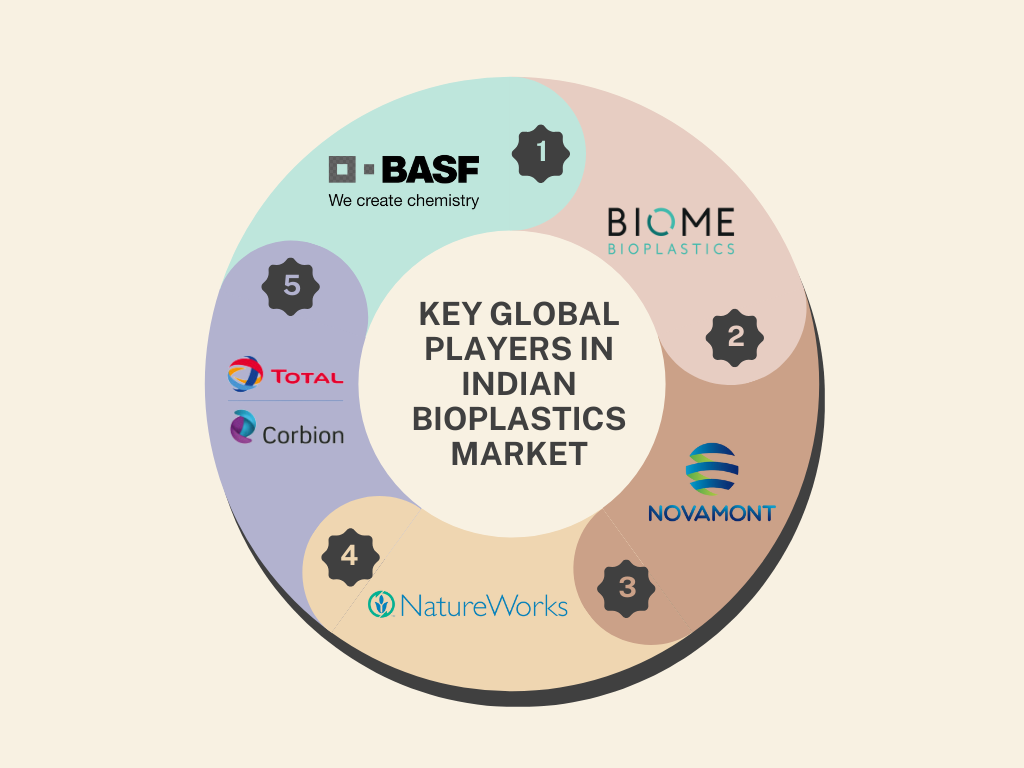

KEY INTERNATIONAL AND GLOBAL PLAYERS IN INDIAN BIOPLASTICS MARKET

- NatureWorks LLC:

- NatureWorks LLC is a leading global manufacturer of biopolymers, particularly PLA (polylactic acid) bioplastics.

- Specific data points:

- NatureWorks’ Ingeo biopolymer, derived from renewable resources such as corn starch, is widely used in various applications, including packaging, fibers, and consumer goods.

- The company has a global production capacity of over 150,000 metric tons of bioplastics per year and serves customers in more than 70 countries.

- BASF SE:

- BASF SE is a multinational chemical company that produces a wide range of bioplastics, including compostable plastics and bio-based engineering plastics.

- Specific data points:

- BASF’s ecoflex® and ecovio® bioplastics are used in applications such as packaging films, bags, and agricultural films.

- The company has a global production capacity for bioplastics exceeding 100,000 metric tons per year.

- Total Corbion PLA:

- Total Corbion PLA is a joint venture between Total S.A. and Corbion N.V., specializing in the production of PLA bioplastics.

- Specific data points:

- Total Corbion PLA’s Luminy® PLA products are used in various applications, including food packaging, disposable tableware, and fibers.

- The company has a bioplastics production facility in Thailand with a capacity of 75,000 metric tons per year.

- Novamont S.p.A.:

- Novamont S.p.A. is an Italian bioplastics company known for its Mater-Bi® biopolymer, a family of bio-based and biodegradable plastics.

- Specific data points:

- Novamont’s Mater-Bi® bioplastics are used in applications such as bags, films, agricultural mulch, and disposable products.

- The company has a production capacity of over 120,000 metric tons of bioplastics per year and operates globally, including in India.

- Biome Bioplastics Ltd:

- Biome Bioplastics Ltd is a UK-based company specializing in the development and manufacturing of compostable and biodegradable bioplastics.

- Specific data points:

- Biome Bioplastics’ portfolio includes a range of bio-based and compostable plastics suitable for various applications, including packaging, disposable products, and consumer goods.

- The company has a global presence and collaborates with partners worldwide to promote sustainable alternatives to conventional plastics.

KEY CHALLENGES FACED BY INDIAN BIOPLASTICS MARKET

- Feedstock Sourcing and Availability:

- Challenge: Limited availability and inconsistent quality of renewable feedstocks, such as corn, sugarcane, and cassava, used in bioplastics production.

- Example: Inconsistent monsoon patterns in India affect crop yields and availability of feedstocks, leading to supply chain disruptions.

- Data Point: According to the Indian Meteorological Department, India experienced below-normal monsoon rainfall in 2019, affecting agricultural output and feedstock availability for bioplastics production.

- Cost Competitiveness:

- Challenge: Higher production costs of bioplastics compared to conventional plastics due to the use of renewable feedstocks and specialized manufacturing processes.

- Example: The cost of bioplastics packaging materials can be 2 to 3 times higher than conventional plastics, making it less attractive for some industries.

- Data Point: A study by the Confederation of Indian Industry (CII) found that the production cost of bioplastics packaging materials can be 30% higher compared to conventional plastics.

- Infrastructure and Processing Facilities:

- Challenge: Inadequate infrastructure and processing facilities for bioplastics manufacturing and recycling, hindering scalability and commercial viability.

- Example: Limited availability of specialized machinery and equipment for bioplastics processing and extrusion in India.

- Data Point: According to industry experts, less than 10% of plastic recycling units in India are equipped to handle bioplastics due to the specialized nature of processing equipment.

- Technological Limitations:

- Challenge: Challenges in developing bioplastic formulations with properties comparable to conventional plastics, including mechanical strength, barrier properties, and heat resistance.

- Example: Bioplastics may have inferior mechanical properties compared to conventional plastics, limiting their use in certain applications.

- Data Point: Research by Indian polymer scientists on improving the mechanical properties of bioplastics is ongoing, but commercialization of these innovations may take time.

KEY INNOVATIONS DRIVING THE INDIAN BIOPLASTICS MARKET

- Advanced Feedstock Sourcing:

- Innovation: Utilization of diverse feedstock sources beyond traditional crops, such as agricultural residues, algae, and waste biomass, to enhance feedstock availability and reduce competition with food sources.

- Example: Research by Indian institutes and startups focusing on the conversion of agricultural residues like rice husk, sugarcane bagasse, and wheat straw into bioplastic feedstocks.

- Data Point: According to a report by the Centre for Science and Environment (CSE), India produces over 500 million tons of agricultural residues annually, offering significant potential for bioplastics feedstock production.

- Bio-Based Monomers and Polymers:

- Innovation: Development of bio-based monomers and polymers from renewable feedstocks through biotechnological processes, enabling the production of high-performance bioplastics with improved properties.

- Example: Research initiatives in India focusing on the synthesis of bio-based monomers like succinic acid, lactic acid, and glycolic acid for the production of bio-based polymers such as polybutylene succinate (PBS) and polyhydroxyalkanoates (PHA).

- Data Point: According to a study published in the International Journal of Environmental Science and Technology, Indian researchers have successfully produced bio-based polymers with varying properties suitable for bioplastics applications.

- Nanotechnology Integration:

- Innovation: Integration of nanotechnology into bioplastics manufacturing to enhance mechanical strength, barrier properties, and heat resistance, enabling the production of high-performance bioplastics for diverse applications.

- Example: Research on the incorporation of nanofillers such as nanocellulose, nanoclays, and graphene into bioplastics matrices to improve mechanical properties and reduce permeability.

- Data Point: A study published in the Journal of Polymers and the Environment highlights Indian research on the development of nanocomposite bioplastics with enhanced properties for packaging and structural applications.

- Biodegradation Enhancement:

- Innovation: Development of additives and formulations to enhance the biodegradability of bioplastics, ensuring efficient degradation in various environmental conditions and end-of-life scenarios.

- Example: Research on the incorporation of bio-based additives such as enzymes, microorganisms, and natural antioxidants into bioplastics formulations to accelerate biodegradation.

- Data Point: Indian startups and research institutions are exploring innovative approaches to enhance the biodegradability of bioplastics, aiming to develop sustainable packaging materials with reduced environmental impact.

- Waste-to-Bioplastics Technologies:

- Innovation: Implementation of waste-to-bioplastics technologies, such as microbial fermentation and enzymatic conversion, to convert organic waste streams into bioplastic feedstocks and products, promoting circular economy principles.

- Example: Pilot projects in India focusing on the conversion of organic waste, such as food waste and agricultural residues, into bio-based polymers and bioplastics through fermentation and bioconversion processes.

- Data Point: According to a report by the Indian Ministry of Environment, Forest and Climate Change, several Indian startups and research institutions are developing waste-to-bioplastics technologies with the potential to address environmental and waste management challenges.

Our specialty focus areas include

Our specialty focus areas include